Achieving an 800 credit score is a financial milestone that signifies exceptional creditworthiness. It is a clear indicator that you manage your credit effectively, making you a prime candidate for the best interest rates and loan terms. But how exactly does one achieve this coveted score? Understanding the factors that contribute to a high credit score and implementing disciplined financial habits can set you on the path to success. Whether you're starting from scratch or looking to improve your current score, the journey to reaching an 800 credit score is within your grasp.

In today’s financial landscape, a good credit score is more than just a number – it's a gateway to numerous financial opportunities. From securing a mortgage with favorable terms to getting approved for a premium credit card, a high credit score holds the power to significantly impact your financial health. But many wonder, what steps are necessary to attain an 800 credit score? The answer lies in understanding the credit scoring system and diligently working towards improving your financial habits.

While achieving an 800 credit score may seem daunting, it is entirely achievable with the right strategies and persistence. By focusing on key elements like timely payments, maintaining low credit utilization, and diversifying your credit mix, you can steadily increase your score. This comprehensive guide will delve into actionable steps and expert insights on how to get an 800 credit score, empowering you to take control of your financial future.

Read also:Asia Monet Ray Age Unveiling Her Journey And Achievements

Table of Contents

- Understanding Credit Scores

- What Is a Good Credit Score?

- Components of a Credit Score

- How to Get an 800 Credit Score?

- Building a Strong Credit History

- Importance of Payment History

- Keeping Credit Utilization Low

- Diversifying Your Credit Mix

- Monitoring Your Credit Regularly

- Avoiding Unnecessary Credit Inquiries

- How Can Credit Cards Affect Your Score?

- How Long Does It Take to Reach 800?

- Common Mistakes to Avoid

- Frequently Asked Questions

- Conclusion

Understanding Credit Scores

Credit scores are numerical expressions representing an individual's creditworthiness, primarily used by lenders to evaluate the risk of lending money. The scores are calculated based on credit history, current debts, and payment patterns, typically ranging from 300 to 850. A higher credit score indicates a lower risk for lenders, thus improving the chances of loan approvals and favorable terms.

Credit scores are calculated using various models, with FICO and VantageScore being the most prominent. Both score ranges are similar, yet they weigh different factors slightly differently. It's crucial to understand these models to effectively manage and improve your credit score.

What Is a Good Credit Score?

A good credit score generally falls between 670 and 739, while anything above 740 is considered excellent. An 800 credit score is exceptional and places you in the top tier of creditworthiness. This score can unlock the best financial products and the most competitive interest rates, saving you significant amounts of money over time.

Achieving a good credit score requires consistent financial discipline, including making timely payments, managing debt responsibly, and maintaining a low credit utilization ratio. It's important to understand the behaviors that contribute to a good credit score and strive to emulate them in your financial practices.

Components of a Credit Score

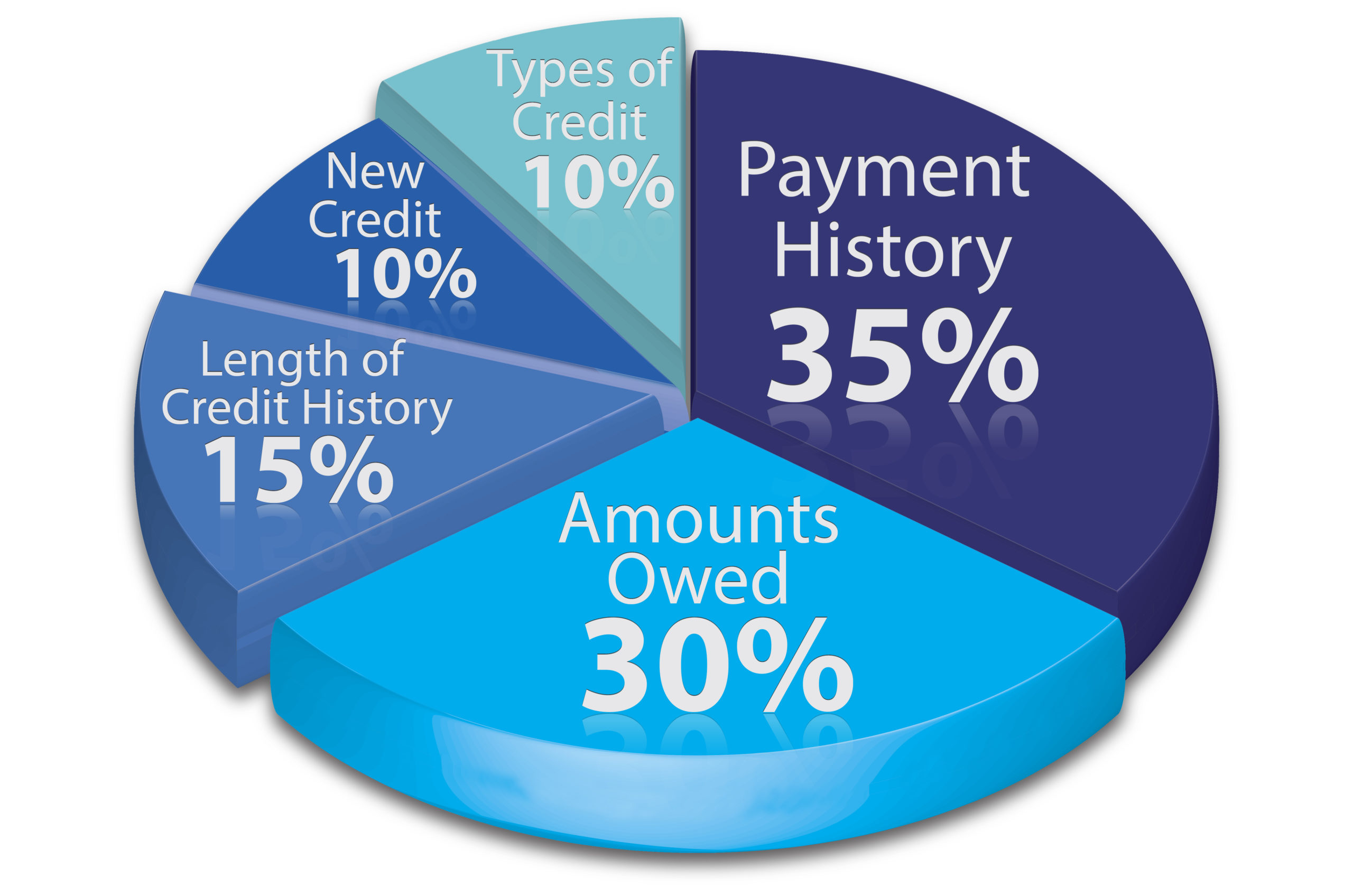

Understanding the components of a credit score is crucial in devising a strategy to improve it. The primary components include:

- Payment History: This is the most significant factor, accounting for about 35% of your credit score. Consistently making on-time payments positively impacts your score.

- Credit Utilization: This is the ratio of your current credit card balances to your credit limits, contributing 30% to your score. Keeping utilization below 30% is advisable.

- Length of Credit History: A longer credit history can improve your score, making up 15% of the total. It reflects the duration of your credit accounts.

- Credit Mix: Having a diverse mix of credit accounts, such as credit cards, mortgages, and installment loans, can contribute 10% to your score.

- New Credit: Opening several new credit accounts in a short period can lower your score, as it accounts for 10% of your credit score.

How to Get an 800 Credit Score?

Getting an 800 credit score requires a strategic approach and consistent financial discipline. Here are some steps to help you achieve this goal:

Read also:Myrna Colleylee An Inspiring Life Of Art And Philanthropy

- Maintain a Clean Payment Record: Always pay your bills on time, as late payments can significantly impact your score.

- Monitor Your Credit Utilization: Aim to keep your credit utilization rate below 30%, and ideally below 10% for an optimal score.

- Limit Hard Inquiries: Avoid frequent hard inquiries by only applying for credit when necessary.

- Keep Old Accounts Open: Longer credit histories are beneficial, so keep old accounts open even if you don't use them regularly.

- Check Your Credit Report Regularly: Regularly review your credit report for errors or discrepancies and dispute any inaccuracies.

- Manage Debts Wisely: Pay down existing debts and avoid accumulating unnecessary debt.

Building a Strong Credit History

A strong credit history is the foundation of an excellent credit score. Here's how you can build and maintain it:

- Start Early: Open a credit account as soon as possible to begin building your credit history.

- Use Credit Responsibly: Make small purchases and pay them off on time to establish a track record of responsible credit use.

- Avoid Closing Accounts: Keep your credit accounts open to maintain a longer credit history.

- Be Consistent: Consistency in managing your credit is key to building a strong credit history.

Importance of Payment History

Payment history is the most crucial component of your credit score, accounting for 35% of the total. Here's why it's essential:

- Reflects Financial Responsibility: A positive payment history demonstrates your ability to manage debt effectively.

- Influences Lender Decisions: Lenders prioritize payment history when assessing credit applications, as it indicates the likelihood of timely repayments.

- Long-Term Impact: Late payments can stay on your credit report for up to seven years, impacting your score negatively.

Keeping Credit Utilization Low

Credit utilization is a crucial factor in determining your credit score, accounting for 30% of the total. To maintain a low credit utilization ratio:

- Monitor Balances: Regularly check your credit card balances to ensure they remain low.

- Request Credit Limit Increases: A higher credit limit can help lower your utilization ratio.

- Make Multiple Payments: Consider making multiple payments throughout the billing cycle to keep balances low.

- Utilize Different Cards: Spread your spending across multiple cards to avoid high utilization on any single account.

Diversifying Your Credit Mix

Having a diverse mix of credit accounts can positively impact your credit score. Here's how you can diversify your credit mix:

- Include Different Types of Credit: Consider having a combination of credit cards, installment loans, and retail accounts.

- Use Credit Wisely: Ensure you manage all types of credit responsibly to avoid negative impacts on your score.

- Balance New and Existing Credit: While diversifying, avoid opening too many new accounts at once.

Monitoring Your Credit Regularly

Regularly monitoring your credit is essential to maintaining a high credit score. Here's why it matters:

- Detect Errors Early: Regular checks help identify and dispute errors or inaccuracies on your credit report.

- Track Progress: Monitoring allows you to track your progress and make informed decisions about improving your score.

- Prevent Identity Theft: Regular monitoring can help detect signs of identity theft early, allowing you to take prompt action.

Avoiding Unnecessary Credit Inquiries

Credit inquiries can impact your score, so it's essential to manage them wisely. Here's how:

- Limit Applications: Only apply for credit when necessary to avoid frequent hard inquiries.

- Shop Around Wisely: When rate shopping, do so within a short time frame to minimize the impact on your score.

- Opt for Soft Inquiries: Whenever possible, choose soft inquiries that do not affect your credit score.

How Can Credit Cards Affect Your Score?

Credit cards can have a significant impact on your credit score, both positively and negatively. Here's how:

- Positive Impact: Responsible use of credit cards can help build a strong credit history and improve your score.

- Negative Impact: High balances and missed payments can lower your score significantly.

- Credit Utilization: Credit cards contribute to your utilization rate, so it's crucial to manage balances wisely.

How Long Does It Take to Reach 800?

Reaching an 800 credit score requires time and consistent financial discipline. Here's a rough timeline:

- Starting from Scratch: It may take several years to build a strong credit history and reach an 800 score.

- Improving an Existing Score: With disciplined efforts, you can improve your credit score by 100 points or more within a year.

- Factors Affecting Timeline: Your starting point, financial habits, and consistency in managing credit all influence the time it takes to reach an 800 score.

Common Mistakes to Avoid

Avoiding common mistakes is crucial in achieving and maintaining an 800 credit score. Here are some pitfalls to watch out for:

- Late Payments: Even a single late payment can significantly impact your score.

- High Credit Utilization: Keeping high balances on your credit cards can lower your score.

- Ignoring Credit Reports: Failing to monitor your credit report can result in errors going unnoticed.

- Applying for Unnecessary Credit: Frequent credit applications can lead to multiple hard inquiries, lowering your score.

Frequently Asked Questions

What is an 800 credit score?

An 800 credit score is considered exceptional and indicates that you are a low-risk borrower. It falls within the top tier of creditworthiness, granting you access to the best financial products and terms.

How can I improve my credit score quickly?

While there are no quick fixes, you can improve your credit score by making timely payments, reducing your credit utilization, disputing errors on your credit report, and avoiding unnecessary credit inquiries.

Does closing old credit accounts affect my score?

Yes, closing old credit accounts can affect your score by reducing your credit history length and increasing your credit utilization ratio. It's generally advisable to keep old accounts open.

How often should I check my credit score?

It's a good practice to check your credit score at least once a year and more frequently if you're planning a significant financial move, such as buying a home or car.

Can paying off debt hurt my credit score?

Generally, paying off debt will positively impact your credit score. However, if it involves closing an account, it could temporarily affect your score due to changes in credit utilization and history length.

Is it possible to have a perfect credit score?

While an 850 is technically the highest credit score possible, maintaining a score above 800 is exceptional and provides similar benefits.

Conclusion

Attaining an 800 credit score is a testament to your financial discipline and responsibility. By understanding the components of your credit score and implementing sound financial practices, you can steadily work towards this goal. Remember, consistency is key, and with time, the benefits of a high credit score will become evident. Whether it's securing a loan with favorable terms or accessing premium credit cards, the effort to achieve an 800 credit score is well worth it.